9 Key Insights from Consensus 2018

Attending the Consensus 2018 blockchain conference was a fascinating ride – despite Vitalik’s tweet, it managed to bring in over 8,500 attendees, 250 speakers and 200 booths of players from all over the block-sphere.

While the amount of info I encountered was overwhelming and I left with a bad case of analysis paralysis, I’ve since had a chance reflect back and let what I learned saturate – resulting in some insights I’d like to share:

Disclaimer: This is NOT investment advice and everything below is my own humble, subjective interpretation of the things I observed.

Lets get started…

1. Blockchain is a feature, not a benefit

It’s important to remember that while blockchain can enable new solutions and benefits, it is not in itself the solution – it’s the means, not the end. The feature not the benefit.

Jimmy Song vs. Joseph Lubin (Bitcoin vs. Blockchain)

The most entertaining panel I attended featured a heated debate about the future of blockchain between Jimmy Song (provocative Bitcoin maximalist and blockchain skeptic) and Joseph Lubin (co-founder of Ethereum & head honcho at Consensys).

While Lubin elaborated on projects Consensys is working on and potential use cases, Song argued that he’d be willing to make a bet that “blockchain tech”—the use of a decentralized ledger without a cryptocurrency—won’t have any significant adoption.

Lubin in turn, offered to gamble “any amount of bitcoin” on the fact that blockchain tech projects by large corporations would have meaningful adoption within the next five years.

What I love about this argument is that it represents a microcosm of two ends of the “believer” spectrum – on one end – you have the crypto maximalist who views blockchain as crypto and the present and future of money, on the other – the blockchain futurist who views crypto as just one blockchain application, who is working on building additional applications.

The “blockchain is here and now and it’s Bitcoin” approach vs. the “blockchain is the internet of value and we haven’t yet scratched the surface” approach.

The former sees Bitcoin as the benefit, the latter sees blockchain as the feature that will create new benefits.

2. Don’t just sprinkle magical blockchain dust over a problem

Another recurring quote I heard from people was that “Blockchain is a solution looking for a problem”.

Song joked “Blockchain is not this magical thing where you sprinkle blockchain dust over a problem” and indeed, he’s right – in most cases, it’s not the solution.

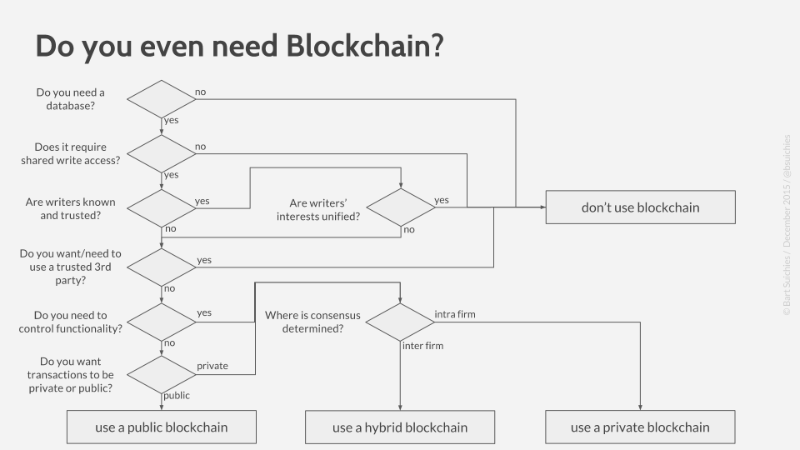

Here’s an example framework for evaluating whether blockchain can help solve a problem:

And then of course there’s the cynic’s view 🙂

3. Blockchain still has fundamental issues with utility

I can’t argue with Song’s logic and opinion that cryptocurrencies are currently the most evolved (and arguably disruptive) blockchain application. Despite an endless array of use case ideas, nothing I encountered and no one I spoke to convinced me we are anywhere near mainstream adoption of this technology.

A printed report by KPMG I picked up notes that:

“The implications [of blockchain] are endless: blockchain has the potential to transform business operating models through the use of smart contracts, supply chain management, intellectual property protection, stock trading and settlement, identity and data management, anti-money laundering and data management to name a few.”

Yet we’re still talking about implications and potential and that’s a key distinction. There are still many puzzle pieces to find and put in place before blockchain starts truly disrupting existing processes and solutions. To name some of the primary barriers:

- Scalability

- Efficiency

- User adoption

- Regulations

When will blockchain go mainstream?

As a marketing consultant and educator, I love dissecting why we do what we do. How do we decide which action to take and which not to take?

Enter Fogg’s Behavioral Model:

Simply put, Fogg shows that for any behavior to occur, three elements must converge at the same moment:

- Motivation

- Ability

- Trigger

When a behavior does not occur, at least one of these three elements is missing.

So what does this have to do with blockchain? For most of it’s potential audience, use cases for Blockchain are still either “Hard to Do”, “Low motivation” or both!

Before it goes mainstream, Blockchain needs to become an easier game to play with better incentives and rewards. It needs more utility and unfortunately – utility will likely take a while, perhaps longer than you think…

4. Blockchain is a TRULY GLOBAL phenomena

While I knew blockchain is big, I guess I had the misconception that the United States was playing a key role in propelling it forward. It’s now clear that the vast majority of the blockchain “problem solving” is not happening in Silicone Valley.

Most companies/teams I talked to were dispersed – their development team in one continent, operations in another, business development in yet another, as well as a scattered community all over the globe.

Other people need Crypto & Blockchain more than you

When I explain blockchain/crypto to Americans hearing about it for the first time, they often don’t get it – “What’s wrong with trusting my bank“ or “why do I need an alternative to the dollar?” they ask.

The answer is – you don’t, but others do.

Crypto and Blockchain are (currently) far more valuable to the unbanked.

In a noteworthy Vitalik reality-check on Twitter, he goes:

- “How many unbanked people have we banked?

- How much censorship-resistant commerce for the common people have we enabled?

- How many dapps have we created that have substantial usage?

- How much value is stored in smart contracts that actually do anything interesting?

- How much actual usage of micropayment channels is there actually in reality?

- The answer to all of these questions is definitely not zero, and in some cases it’s quite significant. But not enough to say it’s $0.5T levels of significant. Not enough.”

5. Institutional Investors Want In

Tokens are a new asset class with high risk and high reward potential. This much is true.

Still, in the grand scheme of things, the current $340+ billion market cap (this will be outdated very soon of course) is just a blip in the world’s investment scene, representing less than 0.5% of the $70+ Trillion managed by Asset Management companies worldwide.

Institutional investors realize it’s not too late to get in and that there’s a chance this is a game they may regret not playing down the road.

Furthermore, their clients are now bugging them about crypto – so it’s no longer something they can ignore.

I’m not suggesting they are looking to allocate substantial portions of their funds into crypto, but rather expand and diversify, treating this as a speculative investment.

Ari Paul (of BlockTower Capital) gave some insights on Twitter:

I’ve had conversations (and unanswered inbounds) from a dozen new crypto brokers and market making firms starting up in the past week. This will reshape the market (especially for largecaps) over the next 6 months dramatically.

Some are institutional players. These brokers provide professionalization and accessibility to institutional investors. A hedge fund that wants to buy $200m in BTC currently has mediocre options. Big bid/ask spreads from OTC desks, limited access to fragmented liquidity.

Others are crypto ecosystem players that will help “connect the dots” between mining pools, whales, and new entrants, resulting in substantially better liquidity generally. Some of this will benefit midcaps and smallcaps.

This will take some time to play out, but I think will add a lot of liquidity, confidence, and ultimately new capital inflows, particularly for coins that are clearly not securities. My guess is that we’ll notice the difference starting in <3 months.

6. Regulators are scrambling

Governments traditionally find it difficult to keep up with new technological breakthroughs –

Blockchain, AI and drones are just three examples of nascent technologies they’re still wrapping their head around. With all the different blockchain protocols, running in distributed, sporadic locations across the globe, generating and facilitating new asset classes [link] and tokens, regulators are still scrambling to figure out what the hell is going on.

There were a number of politicians at Consensus and it’s pretty clear that governments at this point are starting to acknowledge the disruptive – and therefore threatening, potential of this technology on existing governance and financial models.

This creates an interesting dichotomy :

- On one one hand they feel an urge to buckle down with regulations in an effort to maintain control (self preservation) and protect the public

- On the other hand strict regulations may delay but will not stop blockchain from developing, but will divert it elsewhere.

In other words – there’s some game theory going on and governments and regulators are trying different approaches (and everything in-between):

- Some are implementing regulations requiring the complete KYC-type transparency that would be required from any other corporation/entity.

- Some are playing the waiting game, stalling to see what happens in other countries before making any decisions.

- Some (the smart ones IMO) are deliberately implementing lenient regulations in an effort to attract blockchain professionals and projects.

Indeed we’re seeing the formation of new technological blockchain hubs such as Switzerland, Singapore, Saudi Arabia and Bermuda to name a few.

As E. David Burt (Bermuda’s Finance Minister) said at the conference:

You cannot understand where innovation is going to go, but you can be the place where people can feel free to innovate without it being stifled

Blockchain sprouts where there are seeds, working hands and a fertile ground…

7. Public token sales are so 2017

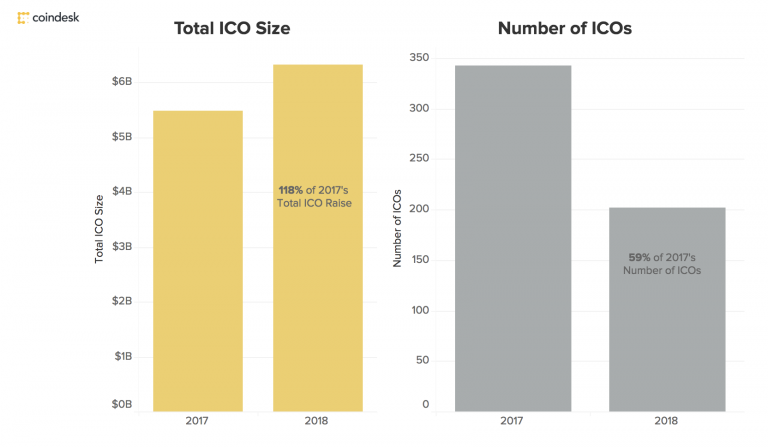

Token sales are still accelerating at rapid pace, having raised over $5.5B in 2017 and already over $6.3B thus far in 2018:

Today, with over 100 ICOs launching every month, there seems to be a rise in opportunistic behavior that focuses on greed rather than solving a real-world problem. It is getting more important to be able to sift through them and understand which ones are building a transparent, needed solution.

I sensed a two sided shift in this momentum:

- Startups are thinking twice about public ICOs, realizing it’s not as easy as it used to be, nore necessarily the right thing to do for things such as security tokens.

- Investors, having a better-albeit-not-perfect ability to evaluate tokens (resources for due diligence such as market analysis, technology audit, team audit etc.) – are putting their bets on companies they believe are more likely to drive profit.

Many of the new token offerings are therefore pivoting to private sales – either to institutional or accredited investors

This pivot is also shifting the momentum from utility tokens (tokens that drive a given blockchain ecosystem) to security, and more specifically equity tokens.

While this is great in terms of driving value, it’s not great for leveling the blockchain playing field to everyone else…

8. We’re in the midst of a protocol race

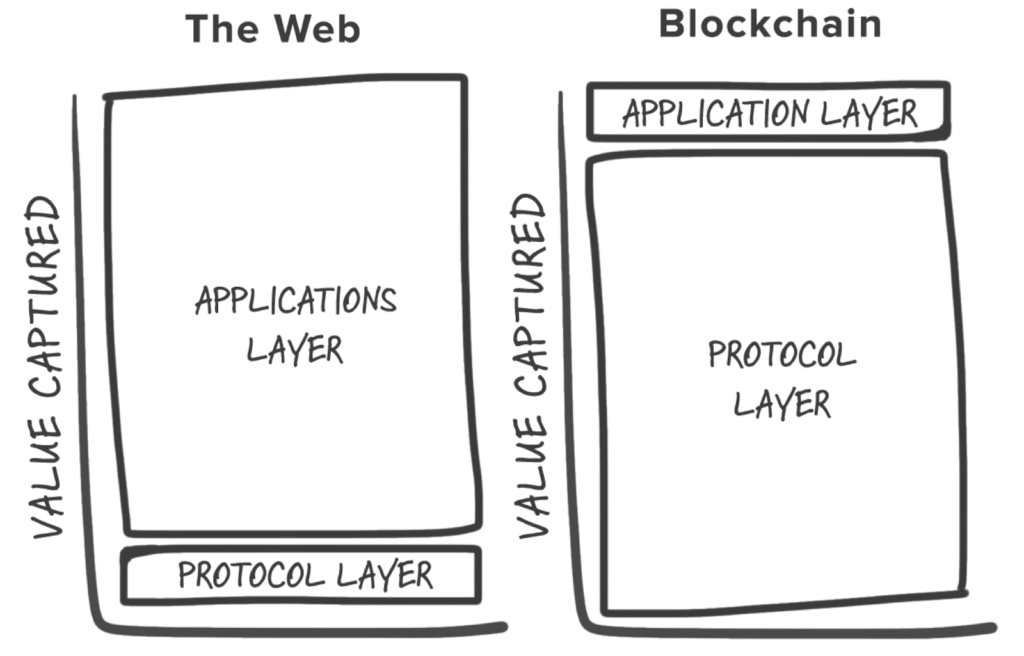

There’s an analogy I like about blockchain which compares it as a protocol to the internet:

The general argument revolves around the idea of “fat protocols”. So just like HTTP or SMTP are a set of fundamental rules that enable the internet or email to run and applications to be built, blockchain allows applications to be built as well.

The difference is that while the HTTP & SMTP protocols created enormous amounts of value, most of that value was captured by the applications built on top of the protocols.

The computer science professors who created HTTP are not billionaires… Mark Zuckerberg is… and many of the fundamental open-source protocols of the Internet era are now run and maintained by not-for-profits, such as the Linux Foundation.

By contrast, the value capture in blockchain occurs by those building and investing at the blockchain’s protocol layer because of the financial incentives (tokens) that are baked into these network’s design. Network participants (users, core developers, third-party developers, investors, service providers) are incentivized to maximize the growth of the blockchain network because if it expands, the token asset appreciates as demand for the network increases.

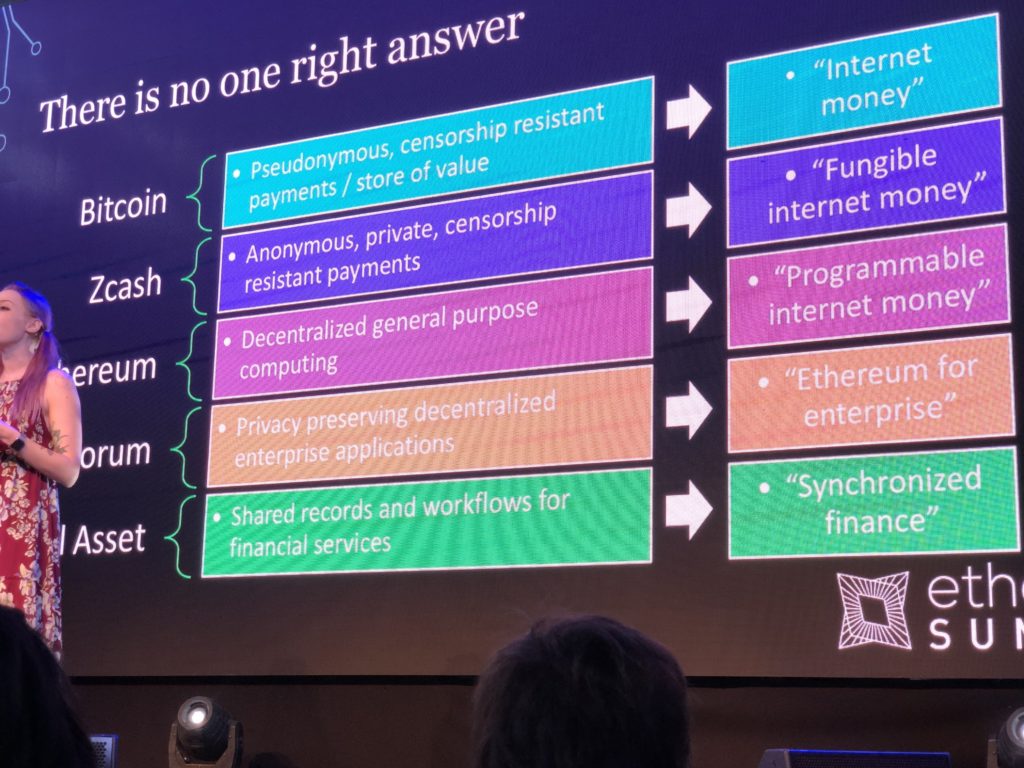

There are thousands of different blockchains and side chains

There is no “one Blockchain to rule them all” – different Blockchains solve different problems to different degrees – such as security, speed or anonymity…

Most of the Blockchain companies I talked to are competing to develop their ecosystem, realizing that:

Investors + Developers + Partnerships → Applications → Utility → Users

While competing platforms scramble for market share by offering a unique value proposition, there’s a clear need for simplified tools allowing developers to build applications, as well as blockchains that talk to each other.

Interoperability: Buzzword of the week

As Amber Baldet (formerly JPMorgan, currently Clovyr) pointed out:

There’s a huge gap between “can we deploy a network” and “what do we do with this network and how does the application work there… Today, [blockchain] software development tools are completely desperate and don’t work together…

Once the protocol race settles down, the next wave of blockchain innovation will come from developers who build Decentralized applications (Dapps) that take the best features from different blockchains, which will open new capabilities and increased utility.

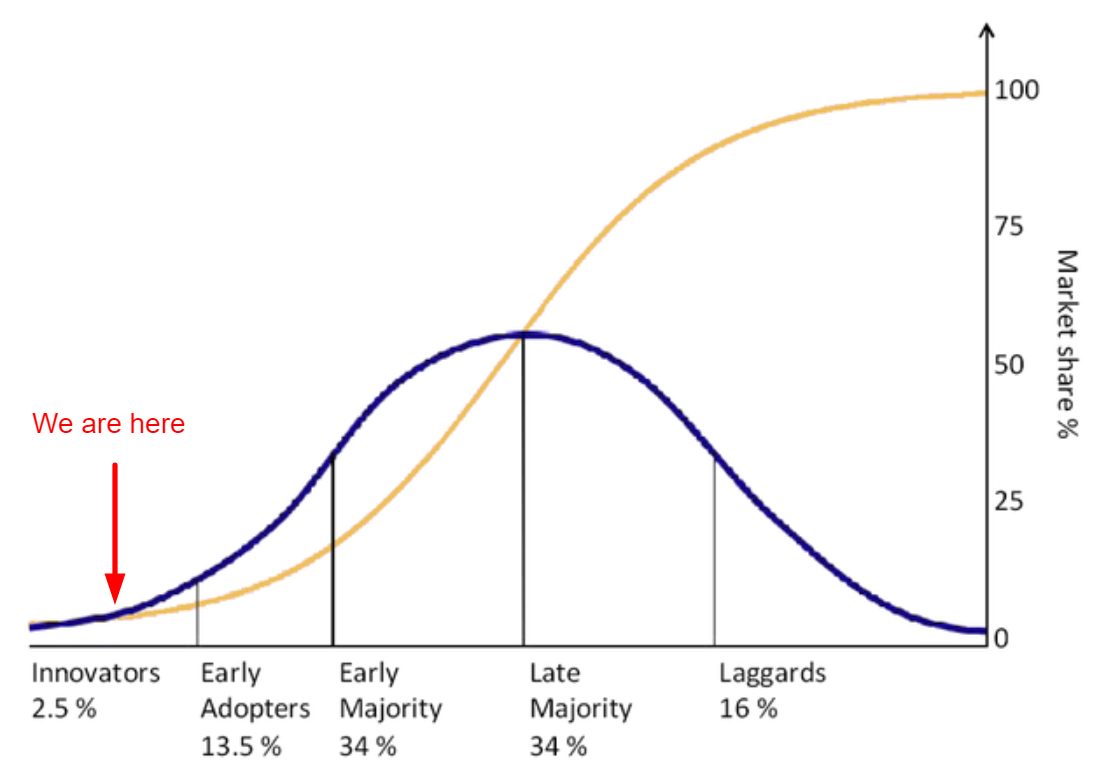

9. We are (super) early in the Blockchain adoption curve

Every new technology goes through an adoption cycle – which is typically illustrated as a classical normal distribution or “bell curve”. The model indicates that the first group of people to use a new product is called Innovators, followed by Early Adopters. Next come the Early Majority and Late Majority, and the last group to eventually adopt a product are called Laggards:

Blockchain is still at a very nascent stage. A stage where users are Innovators who are fascinated by the ideal and the potential represented by this tech, not it’s immediate value…

While Innovators and Early Adopters look for something new and different, only once a new technology is adopted by the Early Majority does it scale. The Early Majority doesn’t care about new or different, they only care about better. They don’t know or care how it works – they only care how it helps.

Final conclusions & takeaways:

- There is so much momentum in this space I can confidently say that one way or another – blockchain is here to stay.

- “Blockchain” as a buzzword is over. Focus will have to shift from raising capital to building value. Companies in the space have to start solving real problems.

- For anyone looking to invest in the space, I suggest investing in meaningful projects . In other words, focus on the projects and teams that are aligned with your values and that you believe have the potential to make the world a better place. With all the shitcoins out there, this is far more important to the success of the industry, than throwing dumb money at dumb projects with a growing market cap.

- Be patient and HODL tight – it’s going to be a long ride…

PS – I am no expert, just an enthusiast looking to learn and perhaps one day become one. Feel free to agree or disagree with any of the above. I’m just a tweet away — so thoughts and feedback are welcome!

Also, this is me jumping intensely (glad I didn’t rip my pants on this one):

Be First to Comment